Shareholder Return Policy and Shareholder Returns

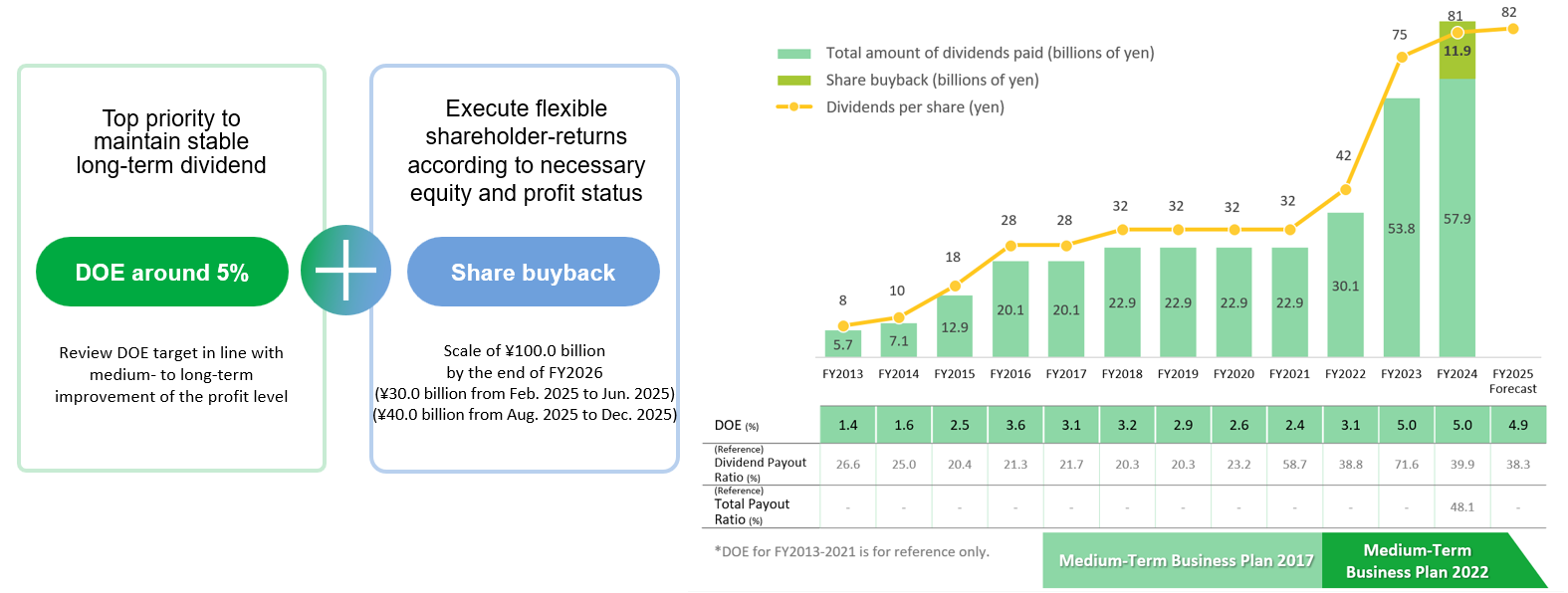

Obayashi's policy on shareholder returns is to maintain long-term stable dividends as the priority. Based on this, we established a policy that sets DOE of around 5% for annual dividends in the Obayashi Group Medium-Term Business Plan 2022. We will review the DOE target in line with the medium-to long-term improvement of the profit level.

In addition, from the point of improving capital efficiency, we will execute flexible shareholder returns by using various ways such as acquisition of own shares and special dividends depending on the amount of required equity and profit status by setting investment capital for each business according to the growth of the construction business and related businesses of the Group and set the necessary equity amount level as one trillion yen after examining the capital structure of each business(comprehensive decision-making will be made in consideration of the profitability and financial status of the Group, PBR, and other factors).

Moreover, aiming to enhance its corporate value, we will strengthen investment in human resources, digital transformation (DX), technology, and enhancement of productivity and create sustainable profits to continue to fulfill the social mission of the construction industry where a decline in the number of engineers and workers in expected while giving top priority to the safety and quality. In addition, we will primarily carry out timely and proactive growth investments in fields where it can establish a competitive advantage and increase profits.

<Reference: Annual dividends based on DOE of around 5%>

| DOE 5% = [(Equity as of the end of the previous fiscal year + Equity as of the end of the current fiscal year)/2]×5% →Target for total annual dividends(interim + year-end) |