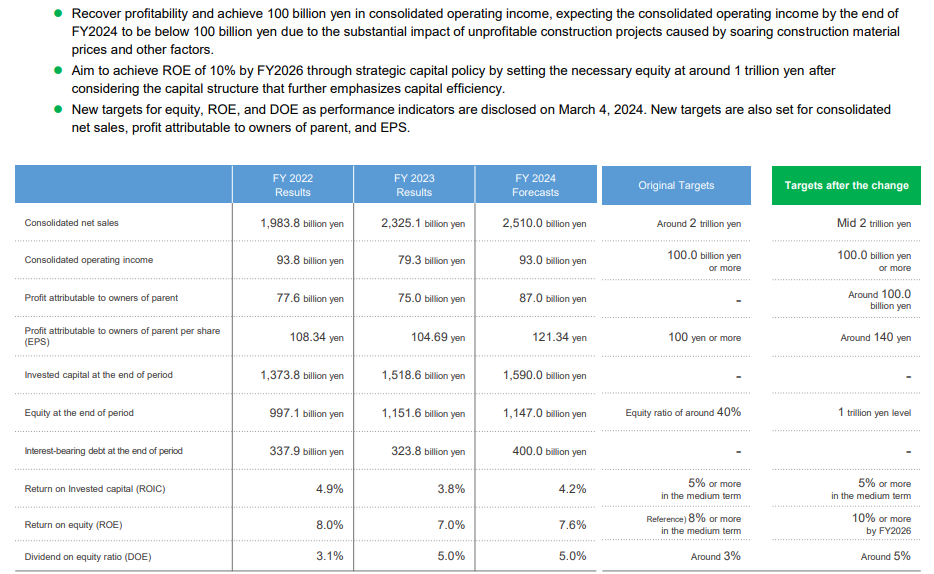

The Obayashi Group Medium-Term Business Plan 2022 stipulates that the Company works to strengthen the business foundation and accelerate company-wide transformation and targets a minimum return on invested capital (ROIC) of 5% or more over the medium term as one of the performance indicators for promoting management that emphasizes capital efficiency.

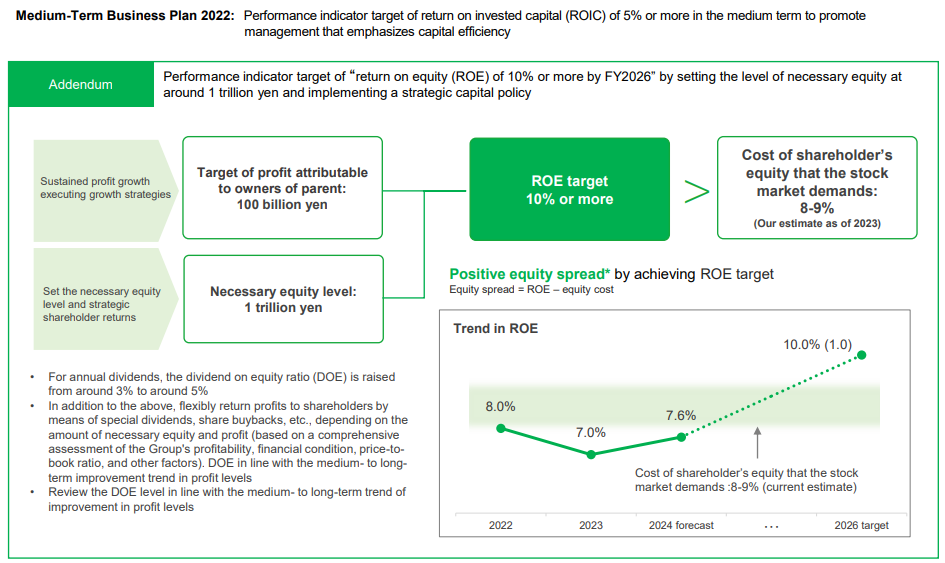

To achieve the target, we will work on striving for sustainable profit growth in each business as before and on controlling invested capital. Additionally, as a result of examining a capital structure that further emphasizes capital efficiency, including the use of finance leverage, we decided to set the necessary equity at around one trillion yen and target a return on equity (ROE) of 10% by fiscal year ending March 31, 2027 (FY2026), the final year of the Obayashi Group Medium-Term Business Plan 2022, by conducting strategic shareholder returns.

Some of the performance indicator targets are revised in "Addendum to Obayashi Group Medium-Term Business Plan 2022 " dated May 13, 2024.

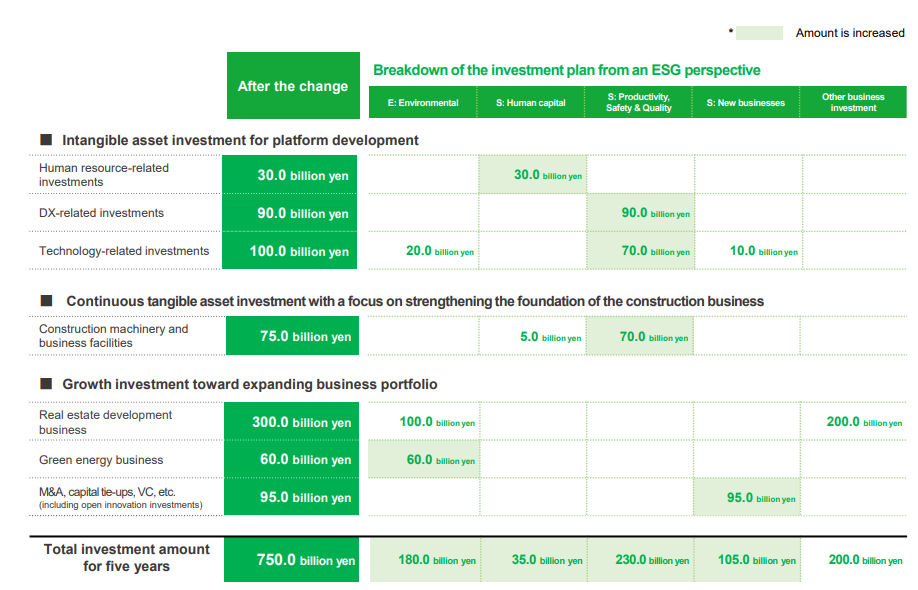

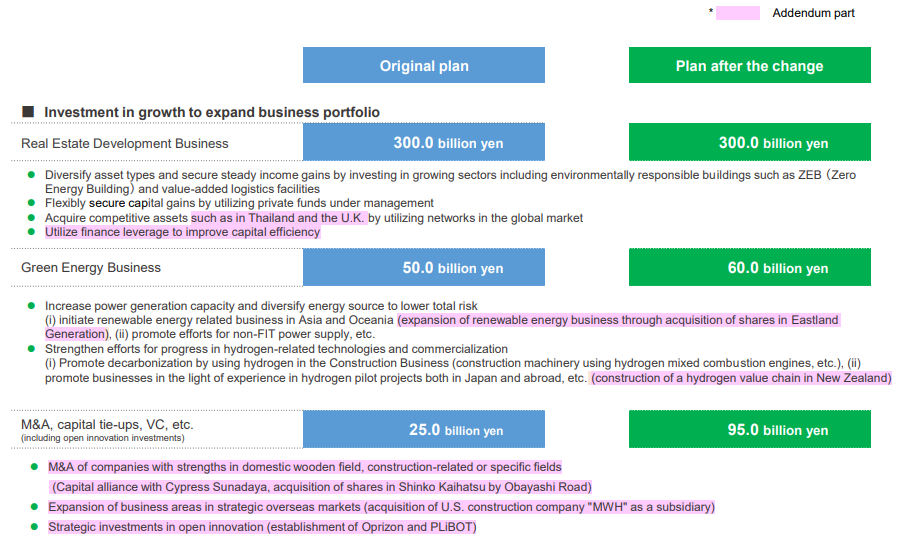

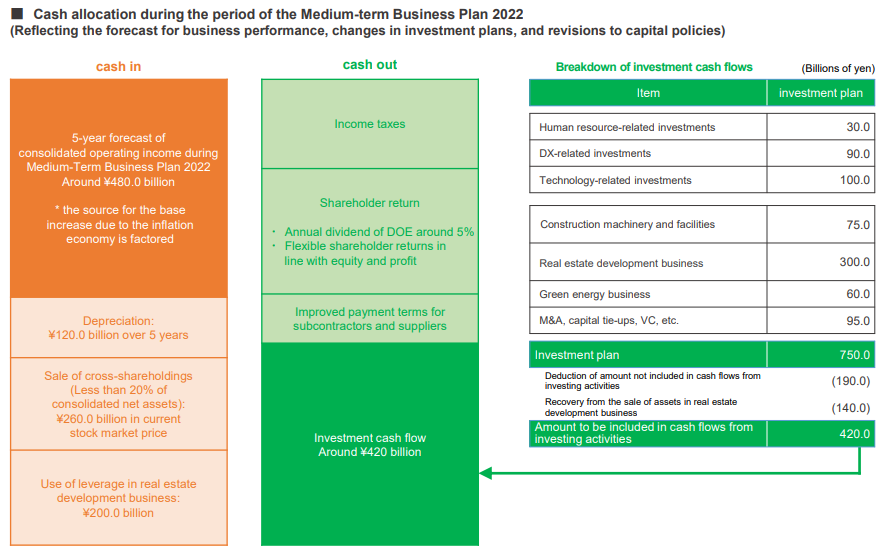

Aiming to enhance its corporate value, the Group carries out growth investments and invests in human resources, digital and technology for the future. Regarding the five-year investment plan of the Addendum to Obayashi Group Medium-Term Business Plan 2022, , we have increased investment in growth for expanding its business portfolio including M&As, in addition to making further investments for strengthening its foundation and reviewed the cash allocation as follows.

Shareholders’ equity cost and weighted average cost of capital (WACC) have been calculated with the capital asset pricing model (CAPM) and are used for internal investment decisions and the management accounting system. We are aware that shareholders’ equity cost for the Company in the CAPM is at the 5% to 7% level, and WACC is around the 4% level. In addition, after examining changes in ROE and PBR over several years, we estimate that the cost of shareholders’ equity that the stock market demands is around 8% to 9%.

We recognize that it is necessary to work on specific measures where capital efficiency is further emphasized with the aim of ROIC of 5% or more that exceeds WACC, and ROE of 10% or more that exceeds the cost of capital as targets.

We aim to achieve ROIC of 5% and ROE of 10% by promoting the following measures: sustainable profit growth by executing a growth strategy and setting necessary equity amount and strategic shareholder returns.

- Generate sustainable profits by further enhancing investment in human resources, DX, technologies, and productivity improvement to continue to fulfill the social mission of the construction industry while giving top priority to safety and quality in the background of the decline in the number of engineers and workers in the construction market

- Identify fields where the Group can establish a competitive advantage in fields contributing to the solution of social challenges, such as carbon neutrality and well-being or fields with a potential for growth for each business, and increase profit by implementing proactive and timely growth investment in the identified fields

- Set investment capital for each business according to the growth of the construction business and related businesses of the Group, and set the necessary equity amount after examining the capital structure of each business, including the use of finance leverage

- Review the necessary capital for investment and equity according to each business scale and other factors based on necessity, and periodically evaluate the capital structure and balance sheet of each business by the Board of Directors from the point of capital efficiency

- Set the necessary equity of the Group during the period covered by the Obayashi Group Medium-Term Business Plan 2022 as the one trillion-yen level and execute strategic shareholder returns

- For annual dividends, increase dividends from a dividend on equity ratio (DOE) of around 3% set forth in the Obayashi Group Medium-Term Business Plan 2022 to DOE of around 5% from FY2023, maintaining long-term stable dividends as the priority.

- In addition to annual dividends, execute flexible shareholder returns by using various ways such as special dividends and acquisition of own shares, according to necessary equity and profit status (comprehensive decision-making will be made in consideration of the profitability and financial status of the Group, PBR, and other factors)

- Review the DOE target in line with the medium- to long-term improvement of the profit level

We will also work on reducing the cost of shareholders’ equity by providing information primarily regarding its growth strategy, approach to our business portfolio, and status of ESG initiatives to stakeholders to improve engagement.